|

DPI-disposal personal income

PCE-personal consumption expeditures |

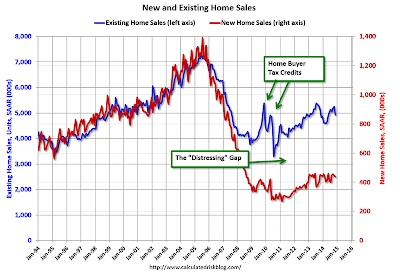

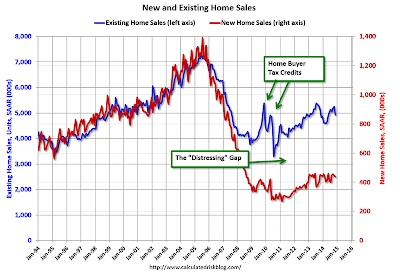

How can mortgage rates be 400 basis points lower than they were in 1995, yet new mortgage applications be at the same level they were twenty years ago? It is a neat trick performed by those economic wizards at the Federal Reserve. As the chart above shows by most important measures, except when manipulated to protect the greedy, 2014 did

not exceeded pre-panic prosperity levels! The $3.5 trillion in cheap money

dolled out to rescue Wall Street from its own profligacy was invested in residential real estate that has driven house prices up by 20% since 2012. The median price for a home in 1995 was $128,000, now it is $281,000. A lion's share of the foreclosures and short sales of 2011-12 were made to hedge funds like Blackstone and big banks like Wells Fargo. Institutional buying has stopped because profits are booked. The country's biggest home builders (KB Homes, Lennar) are warning 2015 will be bad for real estate. Home prices will follow oil into a downward trend due to over-supply. Why? The 30-year US treasury reached a historic yield low---exceeding that of the Greatest Depression--of

2.295%, presaging economic contraction. So who can afford a home when your wages are stuck in the nineties? The people who pay your wages.