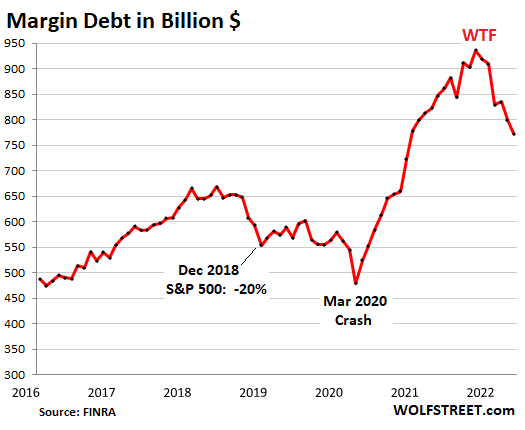

This chart from WolfStreet.com tells US what is going on in the stock markets right now:

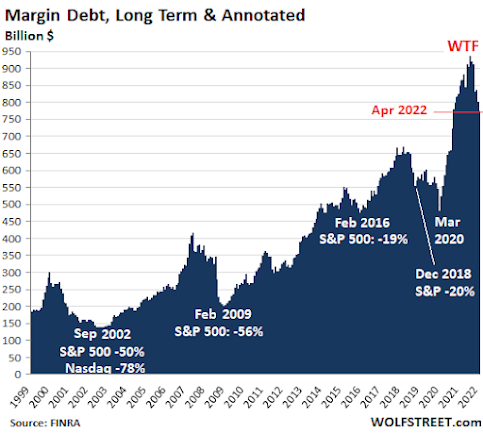

What the steep increases and decreases presage is market movements. Steep increases in margin debt precede significant market sell-offs. Traders buy more stocks on margin to get in on the rise in prices. Margin debt declines during the sell-offs as speculators under pressure sell their holdings to satisfy margin calls. The selling only feeds the market's decline in prices. The second chart shows this relationship over time:

Recently as margin debt declined 17%, the NASDAQ, home to many speculative stock in tech and e-commerce, has dropped 27%. It is just the tip of the iceberg--more unwinding to come.